Citi Clear Card Annual Fee

Demystifying Citi Annual Fee Refund Policy. The best credit card with no annual fee is Citi Double Cash because it has a 0 fee and offers 1 cash back on every purchase plus another 1 cash back when paying the cards bill.

Citibank Clear Card Review Should You Apply Credit Card Review Valuechampion Singapore

Your Citibank Clear Card is embedded with an EMV-compliant smart chip to provide you with exceptional protection against fraudulent activities.

Citi clear card annual fee. Our credit card reward points are here for you to enjoy in the places you spend it most. Unfortunately Citi is no longer waiving the Citi Premier Card s 95 annual fee for the first year. Citi Clear Card Annual Fees.

For new customers principal cardholder annual fee is waived for the first 3 years. The Citi Clear credit card gives you a few ways to save money including a discounted 49 first-year annual fee and an introductory rate of 0 pa. Enhanced Protection Security.

Citi Clear Card Credit Limit. Travel shopping food or cash back for a rainy day. That means Double Cash users who pay in full monthly earn a total of 2 cash back - roughly 2X what the average cash back card gives.

On balance transfers for the first 15 months with no balance transfer fee. How to earn and use them. Were giving the Citi Rewards 3 out of 5 stars.

Theres no annual fee and its easy to get value from the cards supermarket and gas station categories. Citi Clear Card Mileage Earn Rate. Alternative student cards do not have a fee.

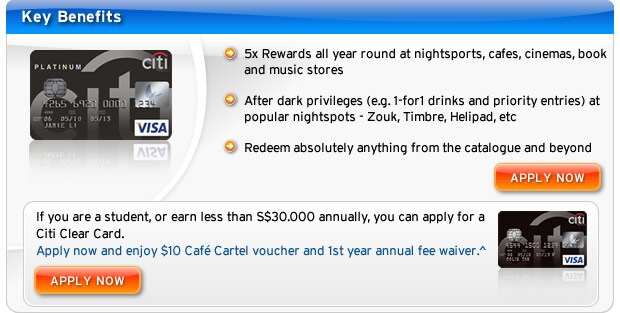

Recently Ive had a few conversations with readers about Citis annual fee refund policy when closing downgrading or product changing a card. Citi does not guarantee this insurance. With a credit card with rewards points such as Citi Clear Card enjoy the benefits of 1-1 movie tickets 1-1 drinks at CBTL more.

Credit cards with higher annual fee come with more benefits and privileges. 1 day agoSignup for the Citi Premier card and get 80000 ThankYou points as a bonus after you spend 4000 within the first three months. Your world of double happiness in less than 10 minutes.

Get a new Citi Clear Card from your phone or computer in an easy paperless signup process. Your rewards automatically round up to the next 10 points boosting the earning potential of every purchase. How to Redeem Your Credit Card Reward Points.

This will revert to the standard annual fee currently 99 in subsequent years. There is no annual fee as well unlike other most credit cards where there is an annual fee charged to cardholders. For example with an annual fee of S535 Citi Prestige Card comes with complimentary night stay when you book a minimum consecutive four-night stay at any hotel or resort and more miles per transaction spent.

Eligible for new Citi Cardmembers only. The Citi Rewards Card offers a competitive sign-up bonus for a no-annual-fee card and sports an unconventional earning structure that rewards small purchases. Terms Conditions Apply.

On top of a free bottle of wine at partner restaurants when you dine and use your Citi card to pay2 youll get complimentary insurances3 a reduced annual fee in the first year4and a low variable rate of just 1499 pa. Actual Citi Miles required may differ at time of redemption. The term spend refers to retail transactions charged to your card.

Earn cash back TWICE. What to do if you annual fee waiver request gets rejected. Minimum income requirement for Malaysian.

Young commuters and those paying for their schooling may prefer a card that does reward these kinds of payments or that instead has a higher overall rewards rate. This will revert to the standard annual fee currently 99 in subsequent years. Spend money earn points and get rewards.

500 credit limit a month. For tertiary students or 18000 pa. This will revert to the standard annual fee currently 99 in subsequent years.

However the hero feature is a 10 rebate on the first 100000 points redeemed each year. Subject to your acceptance you will be billed an annual fee of 49 in the first year. Citis reps typically put it all in a single basket so that you have.

Earn 04 air miles or 1X Citi ThankYou Points on all spend. Due to the high degree of confusion on this matter I sought to clarify the rules. 2996 Waived for first year.

95 annual fee is not waived the first year. This offer is valid until 31 August 2021. Another thing worth mentioning is that Citi Clear Card has an annual fee of S2996 which is waived just 1 year.

Subject to your acceptance you will be billed an annual fee of 49 in the first year. Earn points for every dollar you spend with a Citi credit card and then redeem for rewards. 10 points back for the first 100000 points redeemed each year up to 10000 points.

Citi Double Cash Credit Card Choose a no annual fee credit card and earn 2 cash back on purchases 1 when you buy and 1 as you pay with the Citi Double Cash Card. Citi Clear Card offer. Worry not - if you hesitate to purchase a credit card due to the various fees and charges involved the Citi Simplicity Card guarantees there will be no charges for late payments.

Earn 2 on purchases with 1 cash back when you buy plus an additional 1 as you pay for those purchases. Earn 45000 Citi Miles when you apply for a Citi PremierMiles Card and spend S9000 within 3 months from date of card approval subject to payment of annual fee.

Citi Clear Credit Card Reviewed By Creditcard Com Au

Citibank Clear Card Review Should You Apply Credit Card Review Valuechampion Singapore

Citi Clear Card Should You Apply Valuechampion Hk

Credit Cards Apply For Citi Credit Card Online Citibank Singapore

Citibank Clear Mastercard Nightlife And Entertainment Rewards

Citi Clear Card June 2021 Review Rates And Fees Finder Hk

Citi Clear Card Should You Apply Valuechampion Hk

Citibank Credit Cards Reward You Find Out How Comparehero

Posting Komentar untuk "Citi Clear Card Annual Fee"