Car Sales Tax In Malaysia

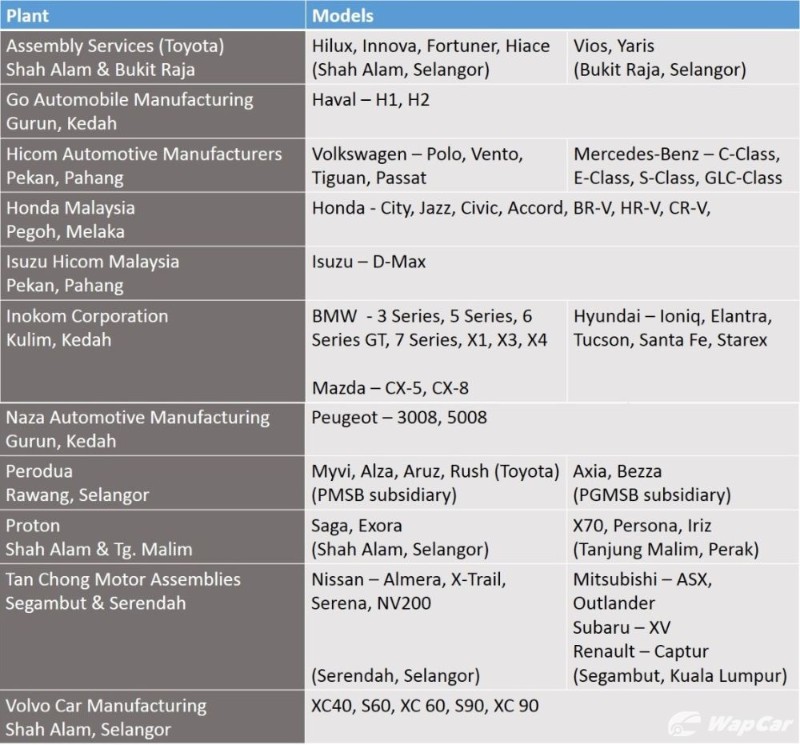

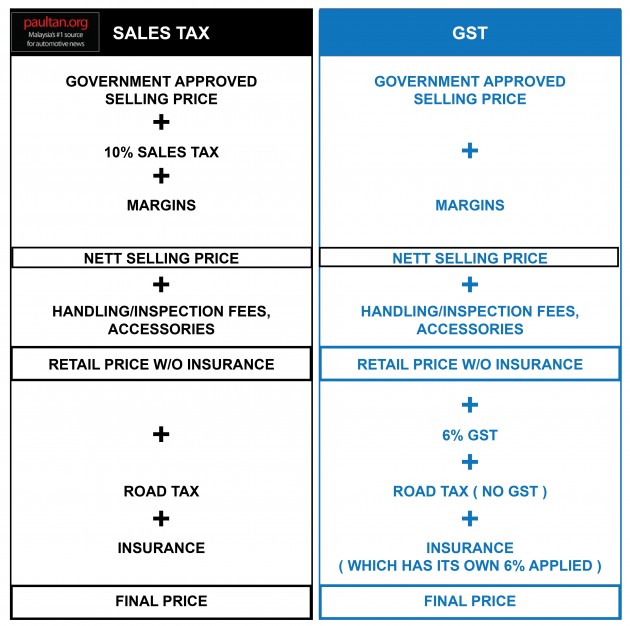

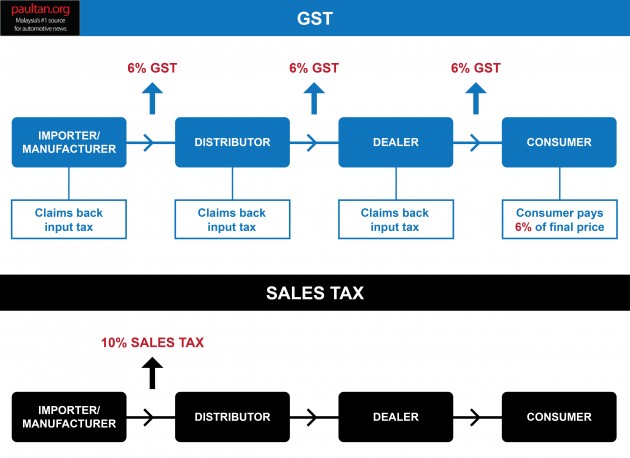

Sales Tax All 30 0 NIL 0 NIL 10 Notes. The sales tax for vehicles in Malaysia is currently set at 10 for both locally assembled and imported cars so the exemption means that the sales tax is fully waived for locally assembled cars and charged at 5 for imported cars.

Tax Holiday And Pent Up Demand Lift Car Sales In July The Edge Markets

Currently the sales tax for vehicles is set at 10 per cent for both locally assembled and imported cars.

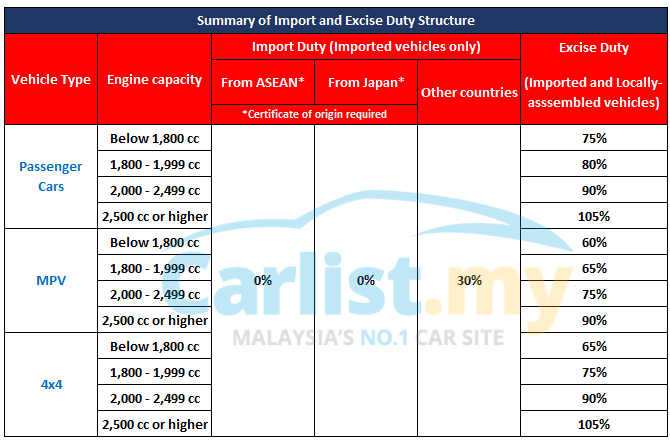

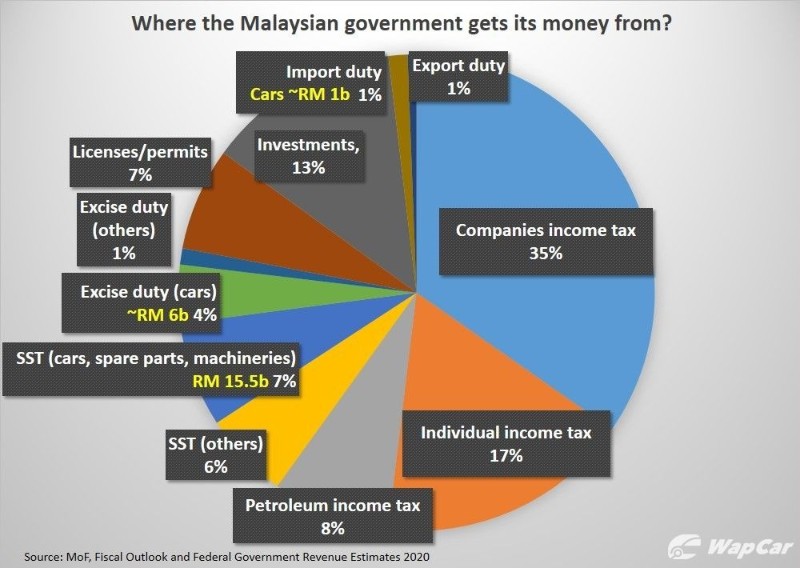

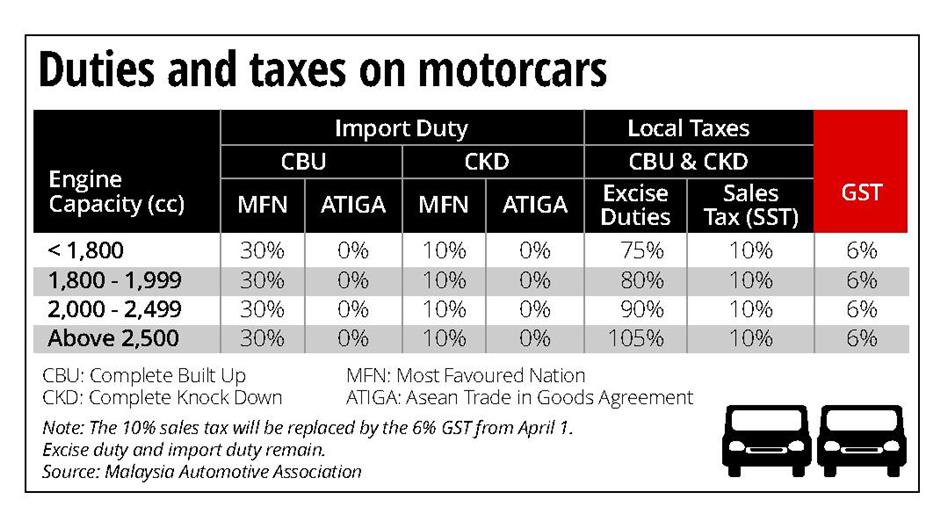

Car sales tax in malaysia. The government yesterday announced 100 sales tax exemption on locally assembled cars and 50 exemption on imported cars from June 15 to Dec 31. Excise duty is between 60 and 105 regardless of CKD or CBU calculated based on the car and its engine capacity while import duty can reach up to 30 depending on the vehicles. Under the Economic Recovery Plan or Penjana Prime Minister Tan Sri Muhyiddin Yassin said the move was aimed at spurring the growth of the local industry.

The government has agreed to exempt sales tax up to 100 per cent for completely-knocked down passenger vehicles and 50 per cent on completely built up cars from June 15 2020 to December 31 2020 he said in a special televised address after announcing the short-term Economic Recovery Plan today. Road tax is used to pay for maintaining the road network nationwide. Combined with the 10 sales tax tax charges for cars can come up to quite a substantial amount making Malaysia one of the countries with the highest tax on cars globally.

The larger a vehicles engine the more road tax is payable. DUTIES TAXES ON MOTOR VEHICLES A PASSENGER CARS INCLUDING STATION WAGONS SPORTS CARS AND RACING CARS CBU CKD CBU CKD IMPORT DUTY. The raw material or components use in the manufacture of taxable.

MFN Most Favoured Nation rate ATIGA ASEAN Trade in Goods Agreement Updated. 100 for CKD locally assembled cars. Note that the sales tax makes up 10 percent other taxes like excise duty and import duty still applies.

In the case of locally manufactured taxable goods sales tax is levied and charge on the finished goods when such finished goods are sold or disposed of. Most of the countries have local taxes of less than 20 whereas Malaysia has an excise tax of 105. The following is a list of the latest prices announced by the different car companies after tax exemption.

The automotive industry has lauded the governments move to fully exempt sales tax for locally assembled cars and halved the sales tax for imported cars to 5 from 10 from June 15 to Dec 31 2020. At present imported cars are subject to an excise duty of between 60 and 105 based on the model and engine capacity while import duty can. However at the same time not all products are necessary to be taxed.

You can refer to our article for a deeper look at how much you would save thanks to the sales tax exemption. Malaysias car industry is dominated by two local manufacturers which are heavily supported by the government through National Car Policy eg. It comes down to the total price though and this is affected by the excise tax.

With the exemption it means that the sales tax is fully waived for the purchase of locally assembled cars while a five per cent tax is imposed for imported cars. Sales tax in Malaysia is a single-stage tax imposed at the manufactures level. 50 for CBU fully imported cars.

If you compare the actual price of the vehicle the amount that you would pay isnt too bad. These include a 100 sales tax exemption on locally-assembled CKD models and 50 on fully-imported CBU models from June 15 until December 31 2020. The sales tax SST Exemption would cover.

Exported manufactured goods will be excluded from the sales tax act. 1 Sept 2018 MALAYSIA. For instance the total tax charges for a Toyota Vellfire could come up to about RM110000 before exemption ballooning the on-the-road price to RM382300 25L model.

The amount of road tax depends on the following factors. Sales tax is only applicable to taxable goods that are manufactured or imported into Malaysia. CKD locally assembled passenger cars will see a cut of 100 percent.

Facilities Under The Sales Tax Act 1972. These excise duties imposed on foreign manufactured cars have made them very expensive for consumers in Malaysia. Malaysia fully waived the sales tax for locally-assembled vehicles and 50 per cent reduction for fully-imported cars to help the local automotive sector recover from the Covid-19 crisis.

If you want to take advantage of the tax cut heres a list of cars assembled in Malaysia for your reference. June 6 2020 1115 AM. List of Latest SST Exempted Car Prices.

The sales tax rate is at 510 or on a specific rate or exempt. In Malaysia car insurance is compulsory and road tax also has to be paid by car owners. Car prices to drop with zero sales tax KUALA LUMPUR.

These local manufacturers are Proton and Perodua.

100 Sales Tax Exemption On New Ckd Cars 50 Exemption For Cbu Until End Of The Year Pm Paultan Org

Take Advantage Of The 100 Sales Tax Cut Here S A List Of Ckd Cars Wapcar

Will Car Prices Go Up Or Down The Star

100 Sales Tax Exemption For Ckd Cars In Malaysia Does This Mean Car Prices Will Go Down By 10 Car In My Life

Gst Impact On Automotive Industry Motorme Motorme

Etcm Announces New Prices Of Nissan Vehicles With Sst Now Cheaper Across The Board News And Reviews On Malaysian Cars Motorcycles And Automotive Lifestyle

Government Mulls Lower Excise Duty For Cars How Low Will Prices Go How Realistic Is It Insights Carlist My

100 Sales Tax Exemption For Ckd Cars In Malaysia Does This Mean Car Prices Will Go Down By 10 Paultan Org

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Gst And Its Impact On Malaysia S Automotive Industry

2020 Sst Exemption All The Revised Car Price Lists Paultan Org

Posting Komentar untuk "Car Sales Tax In Malaysia"